In the online channel-based Forex market, there are options where an individual can assign a third party to trade on their behalf.

Money Managers are the representatives who trade on behalf of their clients. They trade mostly via PAMM and MAMM.

Fundamentally, both MAM and PAMM allows the handling of multiple accounts from one master account. Both of the systems also enable the management of multiple accounts without a firm or investments. These trading modules differ in how they process and function.

What is PAMM?

PAMM stands for Percentage Allocation Money Management. It is a unique portfolio management system that distributes the funds according to the allotment percentage.

Numerous brokers offer this trading solution to their clients to be a portfolio manager (money manager) and investors.

The manager can also assign a percentage of his account to one or more managers.

Whenever any client wants to invest in a money manager, the client gives access to the money manager to manage their fund & trade with it.

Despite having this power, he cannot access the clients’ personal accounts and cannot carry out any withdrawals. The individual clients or investors are the only ones authorized to deposit or withdraw from the assigned managed accounts.

This limited power ensures security. However, with this limited access, the manager has the ability to trade on behalf of his clients via the main account.

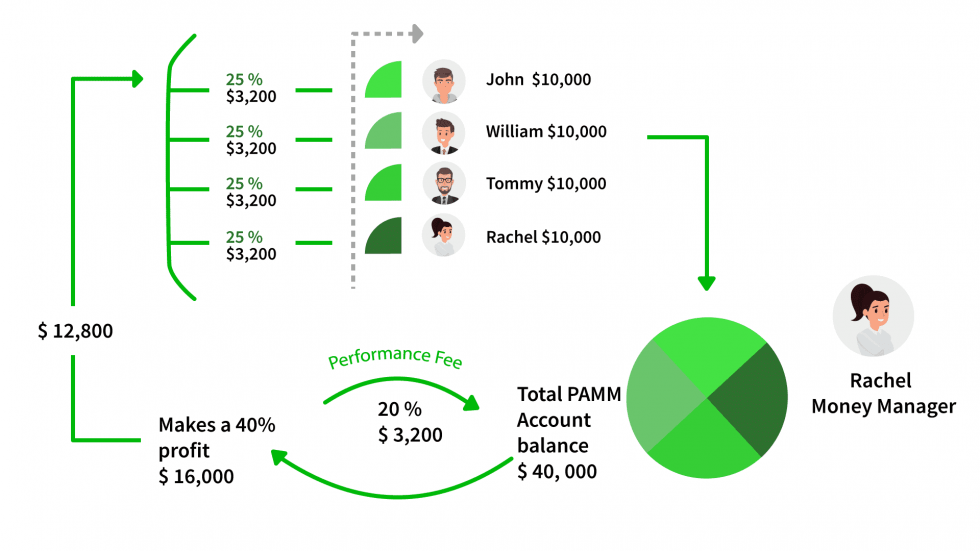

The money manager has one main account that is also popularly known as the “master account”. The master account balance is equal to the total sum of all clients’ individual deposits.

Corresponding to the allocated percentage, the manager’s trades in the master account are automatically copied into the sub-accounts.

The profit in the master account earned from the trade will be distributed according to the pre-set allocation method to the clients by the manager.

For example, let’s say the allocation method is percentage of equity. Suppose the PAMM manager has 3 clients and opened a 100-lot long position in the EUR/USD.

Client 1 accounts for 40% of the total equity

Client 2 accounts for 45% of the total equity

Client 3 accounts for 15% of the total equity

The 100-lot long EUR/USD trade would be distributed as the following.

Client 1: 40 lots of the EUR/USD

Client 2: 45 lots of the EUR/USD

Client 3: 15 lots of the EUR/USD

What is MAM?

MAM stands for Multiple Account Manager. Do not confuse this with MetaQuotes multi-terminal module.

Like a PAMM account, a MAM account also allocates the money according to the respective percentage. However, the manager has more freedom in regulating the leverage and other risk-management factors across sub-accounts.

Since the manager has more flexibility, he/she can trade on a fixed lot basis. This means he can customize his/her service to the account size of the clients. Hence, he can place the number of lots to be traded by each separate account.

Due to the greater flexibility, the managers can also set higher leverage to particular sub-accounts based on their clients’ risk tolerance, given that they have agreed to take the extra risk.

Where PAMM uses one single account to do all the trading and pool the investments, MAM involves using the individual investors’ accounts to carry out the trading instead.

MAM systems involve the distribution of the order placed by the manager between the investors’ accounts, according to the preset parameters.

Suppose the MAM manager has 3 clients and opened a 100 lot long position in the EUR/USD. The manager set the allotment of each client after assessing their accounts.

Client 1 has been assigned 50% of the total equity.

Client 2 has been assigned 30% of the total equity.

Client 3 has been assigned 20% of the total equity.

The manager assigned the lot of each client according to their risk tolerance. Surmising, the manager deems Client 1 has high-risk tolerance, and so he set the client’s lot to be 50 lots of the EUR/USD.

The manager deems Client 2 has less risk tolerance, and Client 3 has even lower resistance. Hence, he assigned 30 lots of the EUR/USD for Client 2 and 20 lots of the EUR/USD for Client 3.

After setting the allotment, the manager will carry out the trading from each client’s account as he has full access to their accounts.

The following table summarizes the differences between MAM and PAMM:

| PAMM | MAM |

| Managers have limited access to clients’ subaccounts. | Managers have more flexibility and can be the Power of Attorney. |

| Managers can’t increase the leverage of the trade. | Managers can increase the leverage of the trade. |

| Trades are not necessarily based on clients’ risk tolerance. | Trades based on clients’ risk tolerance. |

| Withdrawal is possible only at rollover. | Withdrawal is possible either at end of pre-agreed trading interval or at rollover. |

| Minimum deposit depends on the vendor. | Minimum deposit is usually reserved for investors with high risk tolerance. |

| Store/collect all investments in one PAMM account and that account places the order | One order placed by the manager will be split between clients’ accounts according to the preset rules. |

In essence, compared with PAMM, MAM has more flexibility for the money managers but requires high-risk tolerance. PAMM has lesser risks, but the clients will be more independent and have more control. Based on your trading requirements and targets, you can decide which one to opt for.